What Is the FATF Travel Rule?

The FATF Travel Rule, introduced in 2019, extended anti-money laundering (AML) and counter-terrorist financing (CFT) measures to virtual assets and virtual asset service providers (VASPs). Known formally as Recommendation 16, the Travel Rule requires VASPs to collect, verify, and share specific customer information prior to executing digital asset transfers.

The aim of this rule is to prevent the misuse of virtual assets for illicit purposes. By enforcing transparency in crypto transfers, it supports the detection, investigation, and prevention of criminal activity such as terrorism financing and money laundering. It also ensures that information about the originator and beneficiary is readily available to:

- Assist law enforcement with investigations and asset tracing

- Support financial intelligence units in monitoring suspicious transactions

- Enable financial institutions to detect, report, and prevent transactions involving sanctioned individuals or entities

Source: The FATF Recommendations

Which Businesses Are Affected by the Travel Rule?

According to FATF guidance, the Travel Rule applies to VASPs engaged in:

- Traditional wire transfers

- Virtual asset transfers between two VASPs

- Transfers between a VASP and a self-hosted wallet

These applications were reinforced in the 2021 revised FATF guidance. VASPs are expected to perform due diligence on counterparties and safeguard shared customer data.

What Must VASPs Do to Comply?

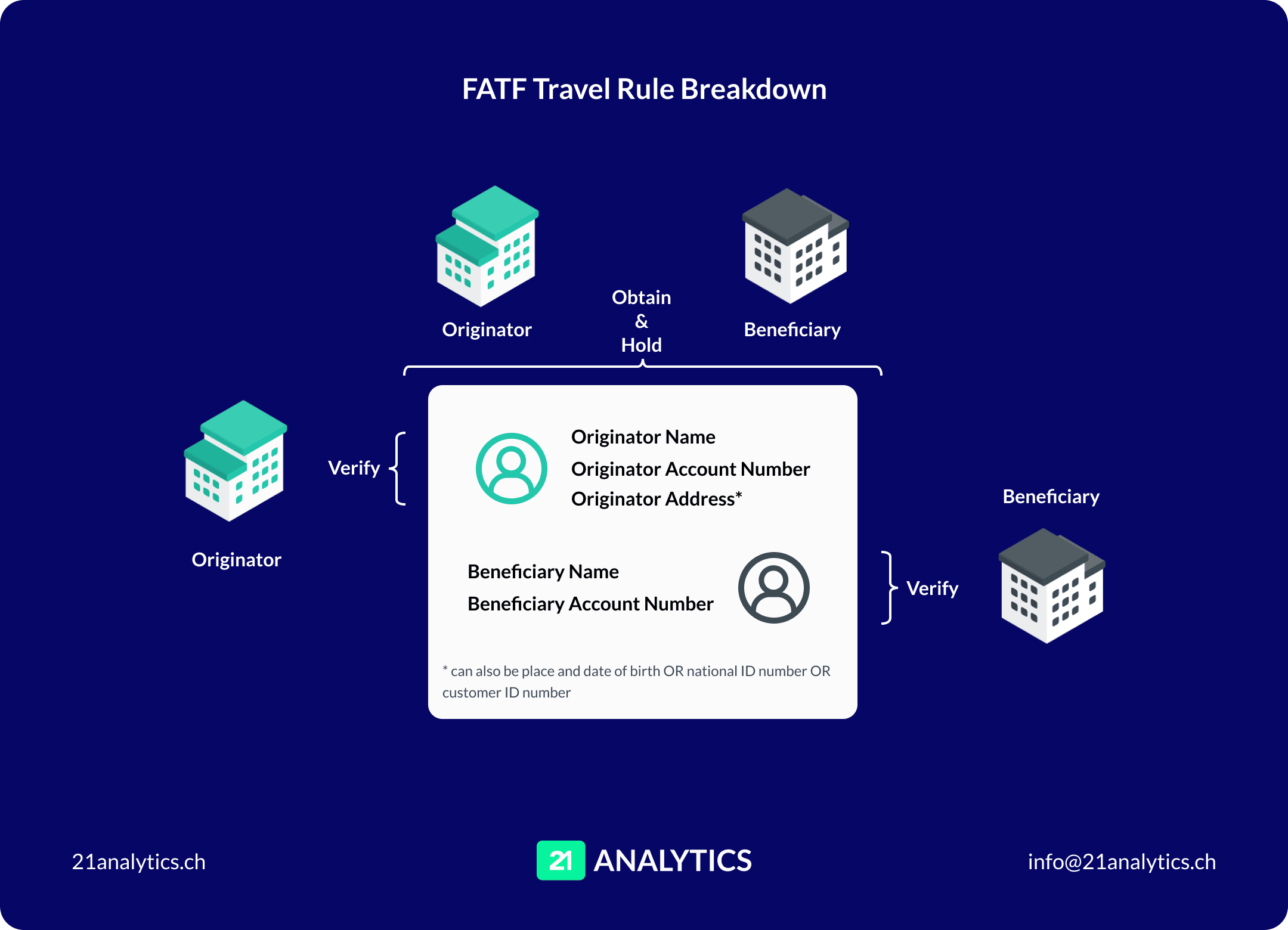

To comply with the Travel Rule, VASPs must:

- Collect originator and beneficiary information

- Verify this data before the transaction occurs

- Share the data with the counterparty VASP

- Retain the data for at least five years

- Provide data to competent authorities upon request

What Data Is Required?

From the originator VASP:

- Name

- Account number

- Physical address, or national ID number, customer ID, or date/place of birth

From the beneficiary VASP:

- Name

- Account number

The data must be transmitted securely and stored according to jurisdictional requirements.

What Is the Travel Rule Threshold?

FATF recommends a threshold of EUR/USD 1,000. However, some jurisdictions, like Switzerland and under the EU’s Transfer of Funds Regulation (TFR), have implemented a zero-threshold—requiring compliance for all transactions.

Does the Travel Rule Apply to All Crypto Transfers?

Yes, if the Travel Rule is active in at least one VASP’s jurisdiction. It may also apply to transactions with self-hosted wallets, depending on local regulations.

What About Self-hosted Wallets?

Self-hosted wallets are considered higher risk. When a VASP receives assets from one, they must collect the same information required in VASP-to-VASP transactions. Some jurisdictions, like Liechtenstein, require wallet ownership verification. Others, like the US, currently do not include self-hosted wallets under the Travel Rule.

VASP Counterparty Due Diligence

VASPs must assess the credibility and compliance of their counterparties before initiating transactions. This includes collecting and storing identification documents, verifying their legitimacy, and ensuring data protection standards are met.

How Can VASPs Comply?

VASPs should implement a Travel Rule solution, a software tool that enables secure, automated compliance with the FATF guidance. These solutions often use protocols like IVMS 101 to standardise data transmission formats.

What Is a Travel Rule Protocol?

A protocol defines the technical rules for exchanging customer data. Without a shared protocol, VASPs may be unable to process each other’s transactions, resulting in errors. A well-adopted protocol ensures interoperability.

The Travel Rule’s Sunrise Issue

Because FATF guidance is not law, jurisdictions implement it at their own pace. Countries like Switzerland, the UK, and Singapore are early adopters. Others are still drafting regulations. This staggered implementation is known as the sunrise issue.

Challenges in Implementation

- Interoperability: VASPs use different solutions and protocols, so compatibility is essential.

- Sunrise Issue: Uneven rollout of regulations makes it hard for global VASPs to apply a single standard.

- Data Protection: VASPs must ensure compliance with their own and their counterparties’ data protection laws, such as the GDPR.

How the Travel Rule Aids AML/CFT

By requiring transparency in crypto transfers, the Travel Rule equips authorities and financial institutions to:

- Track fund movements

- Detect suspicious activity

- Prevent criminal misuse of virtual assets

Ultimately, it is a critical step toward safer, more accountable crypto transactions worldwide.

Find out everything there is to know about Travel Rule solutions.