With the global increase in anti-money laundering and counter-terrorism financing policies and the implementation of the FATF’s Travel Rule, more organisations have come about, along with regulations, resulting in many abbreviations.

Below, we have compiled a list of global supervisory bodies and regulations, along with their abbreviated forms. Additionally, we have included the origin of the supervisory body or regulation and its role to make it easier to reference.

Scroll to the bottom of the text to download a non-exhaustive list.

(H2) 26 Global Supervisory Bodies and Regulation Abbreviations

(H3) Global Abbreviations

(H4) Financial Action Task Force (FATF)

Established in 1989 at a G7 summit, the Financial Action Task Force (FATF) spearheads worldwide efforts to address money laundering, terrorist financing, and proliferation financing.

Moreover, it researches the methods of money laundering and terrorism funding, advocates for global standards to mitigate associated risks, and evaluates the effectiveness of countries’ countermeasures. It consistently monitors how criminals and terrorists generate, use, and transfer funds.

As nations implement effective measures to disrupt illicit financial flows, criminals must seek alternative methods for laundering their illicit funds. The FATF regularly releases reports to raise awareness about the latest techniques in money laundering, terrorist financing, and proliferation financing, enabling countries and the private sector to take necessary steps to mitigate these risks.

(H4) Financial Stability Board (FSB)

Headquartered in Basel, Switzerland, the Financial Stability Board (FSB) advances global financial stability by coordinating efforts among national financial authorities and international standard-setting bodies. It facilitates the development of robust regulatory, supervisory, and other policies within the financial sector. By promoting consistent implementation of these policies across various sectors and jurisdictions, the FSB aims to create a fair and level playing field.

Through its member collaboration, the FSB endeavours to enhance the resilience of financial systems and promote stability in international financial markets. The policies formulated to achieve these goals are implemented by jurisdictions and national authorities.

(H3) Abbreviations for the European Union (EU)

(H4) Markets in Crypto Assets Regulation (MiCA)

The Markets in Crypto Assets Regulation (MiCA) establishes consistent market rules for crypto assets across the European Union. This regulation applies to crypto assets not currently governed by existing financial services legislation.

Key provisions of the issuance and trading of crypto assets, including asset-reference tokens and e-money tokens, address transparency, disclosure, authorisation, and transaction supervision. The new regulatory framework aims to enhance market integrity and financial stability by overseeing public offerings of crypto assets and ensuring consumers are more adequately informed about associated risks.

Read: What Is The Market in Crypto Assets (MiCA) Regulation?

For further information on the EU, click here

(H4) Transfer of Funds Regulation (TFR)

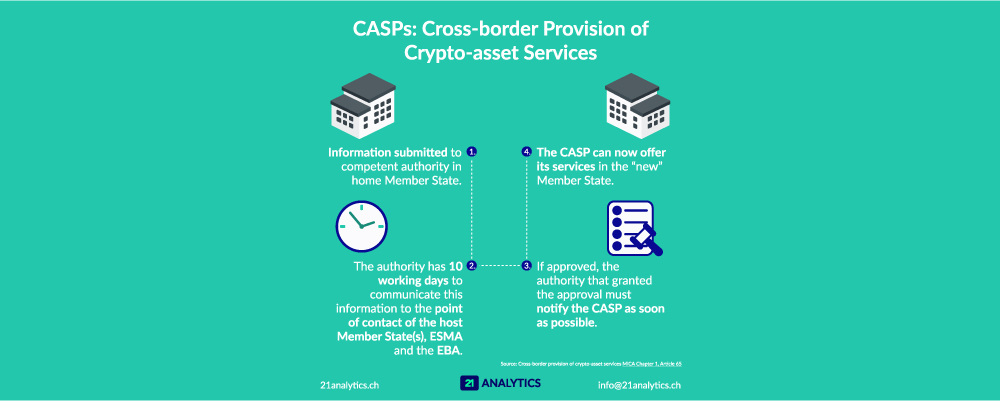

The Transfer of Funds (TFR) is the EU’s implementation of the Travel Rule. The TFR will apply to all crypto asset service providers (CASPs) in the EU. Each CASP will be supervised by its state’s responsible authority.

Read: The Transfer of Funds Regulation (TFR) Summarised

(INCLUDE DOWNLOAD EU BUTTON)

(H4) European Banking Authority (EBA)

The European Banking Authority (EBA) is responsible for implementing a uniform set of regulations for overseeing and supervising banking activities throughout all EU nations. Its objective is to establish a single market for banking products within the EU that is efficient, transparent, and stable.

(H4) European Securities and Markets Authority (ESMA)

The European Securities and Markets Authority (ESMA) is an autonomous EU body established to enhance investor protection and foster stability in financial markets in a well-organized and orderly manner.

(H3) Germany

While Germany is part of the EU and will fall under MiCA and the TFR’s constraints in the future, it implemented the Travel Rule before the rest of the European Union.

(H4) Federal Ministry of Finance (Bundesministerium der Finanzen or BMF)

The Federal Ministry of Finance (Bundesministerium der Finanzen or BMF) is responsible for tax and revenue policy in Germany and plays a significant role in shaping European Union policies.

(H4) Federal Financial Supervisory Authority (BaFin)

The Federal Financial Supervisory Authority (BaFin) is the supervisory body for virtual asset service providers (VASPs) in Germany.

For further information on Germany, click here.

(H3) Estonia

Like Germany, Estonia is a part of the EU and will fall under MiCA and the TFR’s constraints in the future, but implemented its Travel Rule before the rest of the EU.

(H4) Estonian Ministry of Finance’s Financial Intelligence Unit (FIU)

The Estonian Financial Intelligence Unit (FIU) is the supervisory body for VASPs (virtual currency service providers) in Estonia.

For further information on Estonia, click here.

(H3) Abbreviations for Switzerland

(H4) Swiss Financial Market Supervisory Authority (FINMA)

The Swiss Financial Market Supervisory Authority (FINMA) safeguards all financial providers, like VASPs and entities in Switzerland, ensuring the proper functioning of the Swiss financial market. Additionally, FINMA supports and implements the recommendations issued by FATF.

(H4) Self-regulatory Organisation (SRO)

A self-regulatory organisation (SRO) is an entity, such as a non-governmental organisation, with the authority to independently establish and enforce industry-specific and professional regulations and standards.

In Switzerland, the Anti-money Laundering Act (AMLA) states that financial intermediaries must become members of an SRO to prevent money laundering. SROs are supervised by FINMA.

The Financial Services Standards Association (VQF) is an example of an SRO.

For further information on Switzerland, click here.

(INCLUDE DOWNLOAD SWITZ BUTTON)

(H3) Abbreviations for the United Kingdom (UK)

(H4) Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) oversees cryptoasset businesses and implements the Travel Rule in the United Kingdom.

(H4) Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR)

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR) is the legislation under which cryptoasset businesses fall. According to the Legislation, cryptoasset businesses are included under obliged entities.

For further information on the UK, click here.

(INCLUDE DOWNLOAD UK BUTTON)

(H3) Abbreviations for outside the European Union

(H3) Canada

(H4) Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is the supervisory body for VASPs (money services businesses) in Canada.

(H3) The Cayman Islands

(H4) Cayman Islands Monetary Authority (CIMA)

The Cayman Islands Monetary Authority (CIMA) is the supervisory body for VASPs in the Cayman Islands.

For further information on the Cayman Islands, click here.

(H3) Dubai (An Emirate of the United Arab Emirates)

(H4) Dubai Financial Services Authority (DFSA)

The Dubai Financial Services Authority (DFSA) is an independent regulator of financial services within the UAE. It oversees and ensures compliance with the anti-money laundering and counter-terrorist financing requirements applicable in the Dubai International Finance Centre (DIFC) for its regulated community.

(H4) Virtual Asset Regulatory Authority (VARA)

The Virtual Asset Regulatory Authority (VARA) is the supervisory body for VASPs in the Emirate of Dubai.

For further information on Dubai, click here.

(INCLUDE DOWNLOAD DUBAI BUTTON)

(H3) Gibraltar

(H4) Gibraltar Financial Services Commission (GFSC)

The Gibraltar Financial Services Commission (GFSC) is the supervisory body for VASPs in Gibraltar.

For further information on Gibraltar, click here.

(H3) Hong Kong

(H4) Securities and Futures Commission (SFC)

The Securities and Futures Commission (SFC) is the supervisory body for VASPs in Hong Kong.

For further information on Hong Kong, click here.

(H3) Liechtenstein

Although Liechtenstein is part of the Schengen area, it is not part of the EU and, therefore, does not fall under the constraints of MiCA and the TFR.

(H4) Financial Market Authority (FMA)

The Financial Market Authority (FMA) is the supervisory body for VASPs (TT service providers) in Liechtenstein.

For further information on Liechtenstein, click here.

(H3) Singapore

(H4) Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore (MAS) is the supervisory body for VASPs in Singapore.

For further information on Singapore, click here.

(H3) The United States of America (US)

(H4) Commodity Futures Trading Commission (CFTC)

The Commodity Futures Trading Commission (CFTC) regulates virtual assets, which are considered commodities, for example, bitcoin.

(H4) Financial Crimes Enforcement Network (FinCEN)

The Financial Crimes Enforcement Network (FinCEN) plays an essential role in regulating cryptocurrencies in the US, but its primary function is to regulate crypto assets according to AML/CFT purposes.

(H4) Office of the Comptroller of the Currency (OCC)

The Office of the Comptroller of the Currency (OCC) is responsible for overseeing banks

participating in the crypto ecosystem.

(H4) Office of Foreign Assets Control (OFAC)

The Office of Foreign Assets Control (OFAC) oversees compliance with US cryptocurrency regulations involving sanctions.

(H4) Securities and Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) regulates the securities markets and crypto assets and protects investors.For further information on the USA, click here.